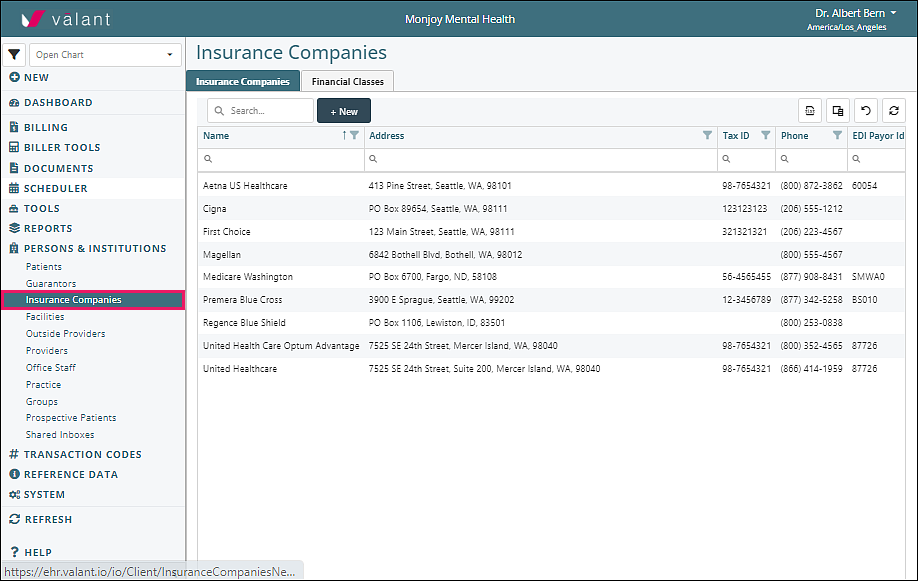

Persons & Institutions | Insurance Companies is where practices can navigate to create and manage insurance company information, financial classes, and fee schedules.

Benefits of Financial Class and Fee Schedules

- Multiple insurance companies can be associated with the same Fee Schedule, using Financial Class

-

Fee Schedules can be downloaded at multiple hierarchical levels

- The date range

- All versions for one Financial Class

- All Fee Schedules for all Financial Classes

- New Fee Schedules can be uploaded by csv

- Changes to Fee Schedules can be uploaded by csv

- Different Fee Schedules can be created for Incident-to Supervision, using the ITB Supervisor field for providers

- POS codes can be set in the Fee Schedule

- Fee Schedule updates can be “pushed” to unrecorded appointments

- Patient Insurance changes can be “pushed” to unrecorded appointments

- Provider contractual status with insurances can be edited in batches in the Provider page

Fee Schedule Scenarios

Verify / Track Insurance Rates

Some practices have providers with different credentials. Insurance companies can pay different rates, based on the provider’s credentials. When a practice chooses to track insurance contract rates by each provider’s credentials, a financial class will need to be created for each insurance. This will allow the rate to be entered on each transaction code.

- Create a Financial Class (e.g. BCBS PPO)

- Select insurance companies that pay the same rates

- Add a Default Fee Schedule – include appropriate telehealth modifiers for this payer

- Copy the Default Fee Schedule – Change the “Fee Schedule Version” name in the csv file according to the Billing Type(s) (e.g., Therapists). Note that this name will be visible when users add appointments or charges.

- Assign Billing Type(s) - add the Billing Type “Name” from Reference Data | Billing Types (e.g., Psychologist)

- Enter the rate for each code that will be paid for this Billing Type(s)

- Copy this Fee Schedule – Change the “Fee Schedule Version” name in the csv file according to the Billing Type(s) (e.g., Prescribers)

- Assign Billing Type(s) - add the Billing Type “Name” from Reference Data | Billing Types (e.g., MD)

- Enter the rate for each code that will be paid for this Billing Type

In summary, when a payment is received for a provider on a code that is attached to a fee schedule, it will cross reference the payment with the expected rate and let you know if it doesn’t match. In addition, there are several reports that will provide you with the Net Accounts Receivable.

Provider Modifiers Required by Insurance

E.g., Medicare GY modifier

Some insurance companies require that a modifier is used for services rendered by specific provider credentials. This requires a fee schedule with the modifiers assigned to the appropriate codes for each bill type that represents the provider’s credentials. This will populate the appropriate modifiers for each provider.

- Create a Financial Class (e.g., Medicare Payers)

- Select insurance companies that have the same modifier requirements

- Add a Default Fee Schedule

- Copy the Default Fee Schedule – Change the “Fee Schedule Version” name in the csv file according to the Billing Type(s) (e.g., Counselors). Note that this name will be visible when users add appointments or charges.

- Assign Billing Type(s) - add the Billing Type “Name” from Reference Data | Billing Types (e.g., Social Workers)

- Enter the modifier required by the payers for the procedure codes for the providers with this Billing type (e.g., modifier GY)

In summary, when a charge is created for the insurances in this financial class with the provider billing type the modifier from the fee schedule will automatically be added to the charge. This reduces the need for multiple procedure codes with the same CPT code to add modifiers by default.

Demonstration Video

Articles for More Information